Harmonic Patterns PDF

Harmonic Patterns Cheat Sheet Download (PDF File) In the documents below, we have attached all shapes and ratios of harmonic chart patterns so you can integrate them into your trading strategy. Harmonic Patterns Cheat Sheet PDF [Download] Why Should You Use a Harmonic Pattern Cheat Sheet?

Harmonic Patterns Cheat Sheet PDF

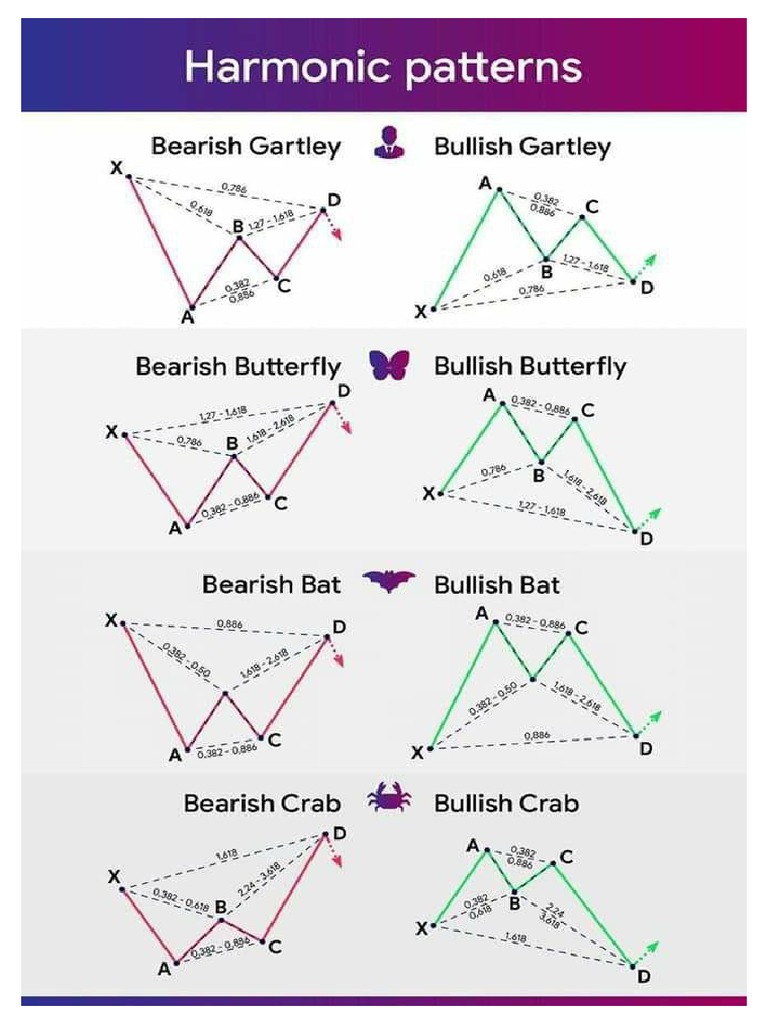

Harmonic patterns are chart patterns that form part of a trading strategy - and they can help traders to spot pricing trends by predicting future market movements. They create geometric price patterns by using Fibonacci numbers to identify potential price changes or trend reversals.

Harmonic Patterns Cheat Sheet PDF

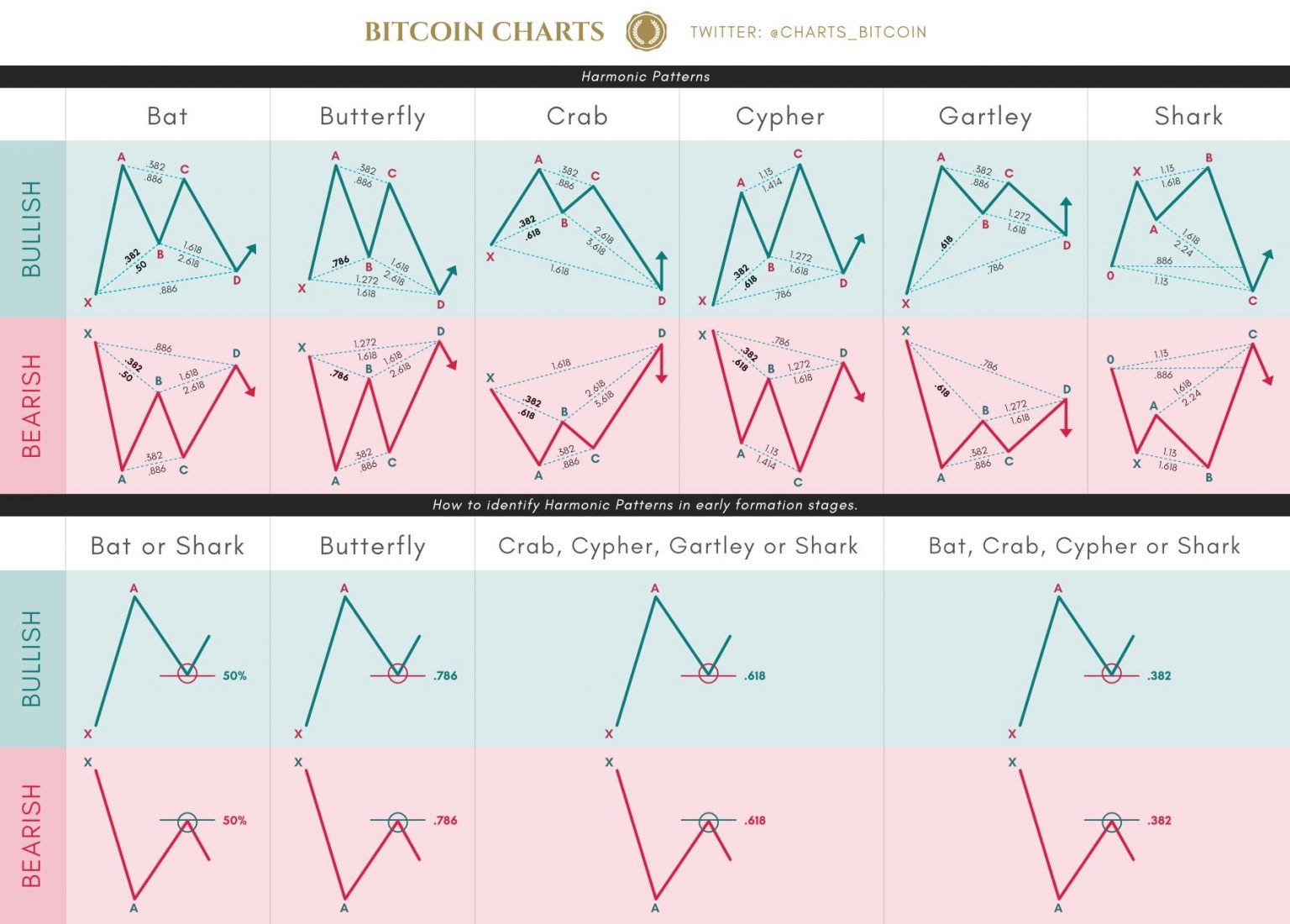

Like any other harmonic pattern, the theory behind the Cypher chart pattern is that there is a strong correlation between Fibonacci ratios and price movements. Eventually, the market is expected to reverse from point D after the four market swing wave movements - X to A, A to B, B to C, and C to D. B point retracement of the primary XA leg ranges between 38.2% to 61.8% Fibonacci levels.

Harmonic Patterns PDF

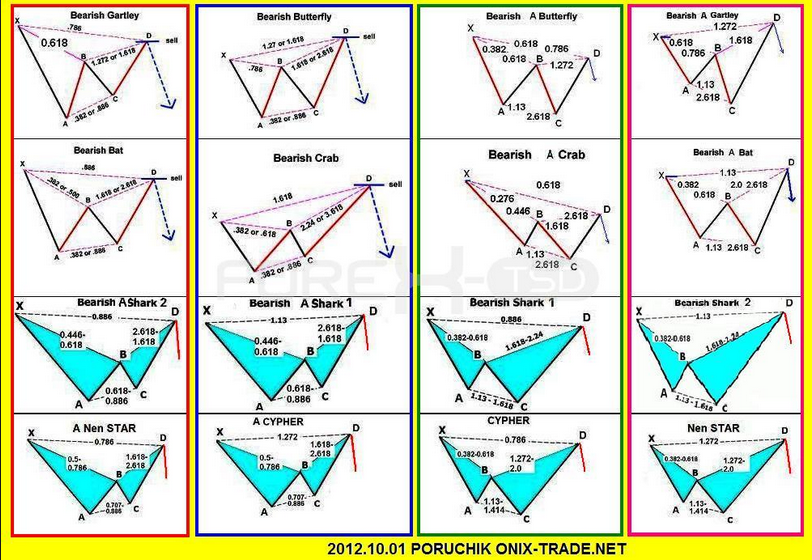

Harmonic Shark Patterns 1.133 0.886 1.775 0.503 0.321 2.557 1.132 1.618 Bearish Shark Pattern 1.627 1.139 2.513 0.323 1.775 0.88 1.13. Bullish Deep Crab Patterns 0.886 1.618 1.932 0.886 Bearish Deep Crab Patterns . 5-0 Pattern Cheat Sheet 2.242 0.197 1.618 Bullish 5-0 Pattern 1.618 0.196 eansh 5-0 Patter 1.618

Harmonic Trend Patterns Cheat Sheet PDF Market Trend Behavioral

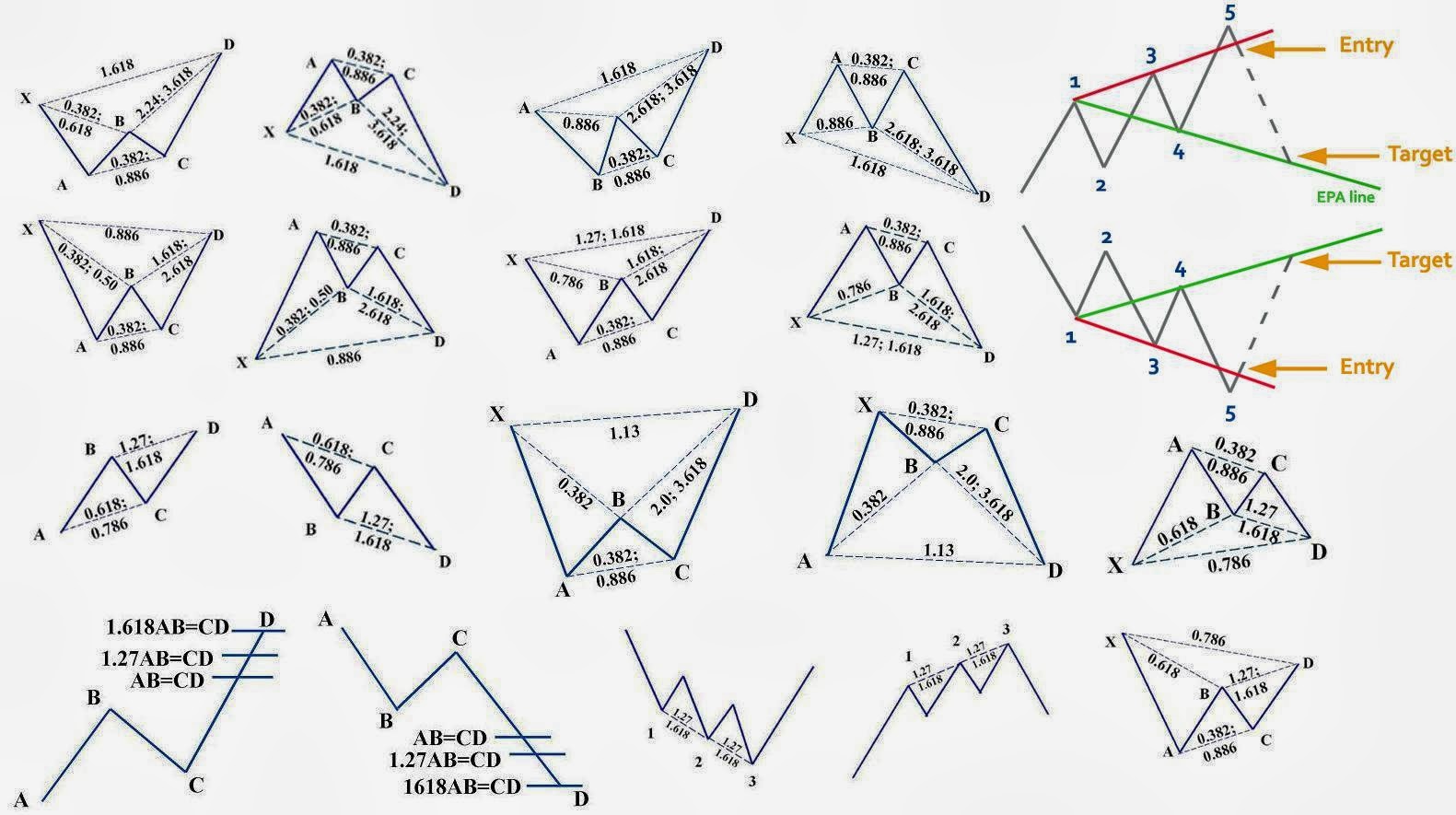

Harmonic trading refers to the idea that trends are harmonic phenomena, meaning they can subdivided into smaller or larger waves that may predict price direction. Harmonic trading relies on.

Harmonic Patterns Cheat Sheet PDF

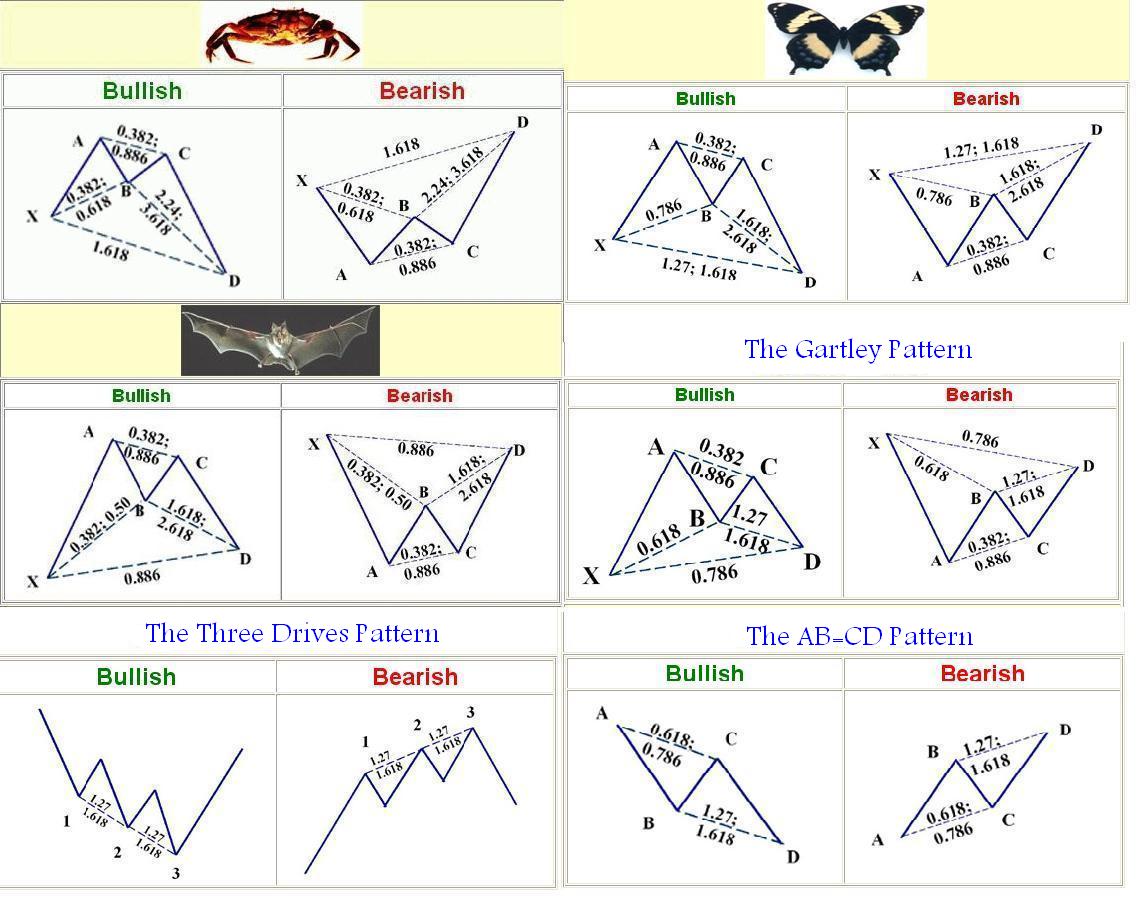

Harmonic Patterns A subset of M & W Patterns from books written by Larry Pesavento, Scott Carney, Jim Kane and others By Emmanuel Nyemera, PhD Three Drives to a Bottom Three Drives to a Top Shark Shark 5-0 Pattern 5-0 Pattern . Harmonic Patterns

Harmonic Patterns Explained For Beginners

This har-monic phenomenon occurs in all walks of life and is usually determined by specific harmonic patterns. Harmonic pattern detection includes rec-ognition of key price swings aided with Fibonacci ratios to identify key reversal points and levels.

Harmonics Cheat Sheet.pdf

Harmonic patterns are geometric chart formations that currency traders use to interpret future price movements in the forex market. These patterns are based on specific Fibonacci retracement and extension levels, helping traders identify potential trend reversals and trading opportunities.

Harmonic Patterns Cheat Sheet PDF

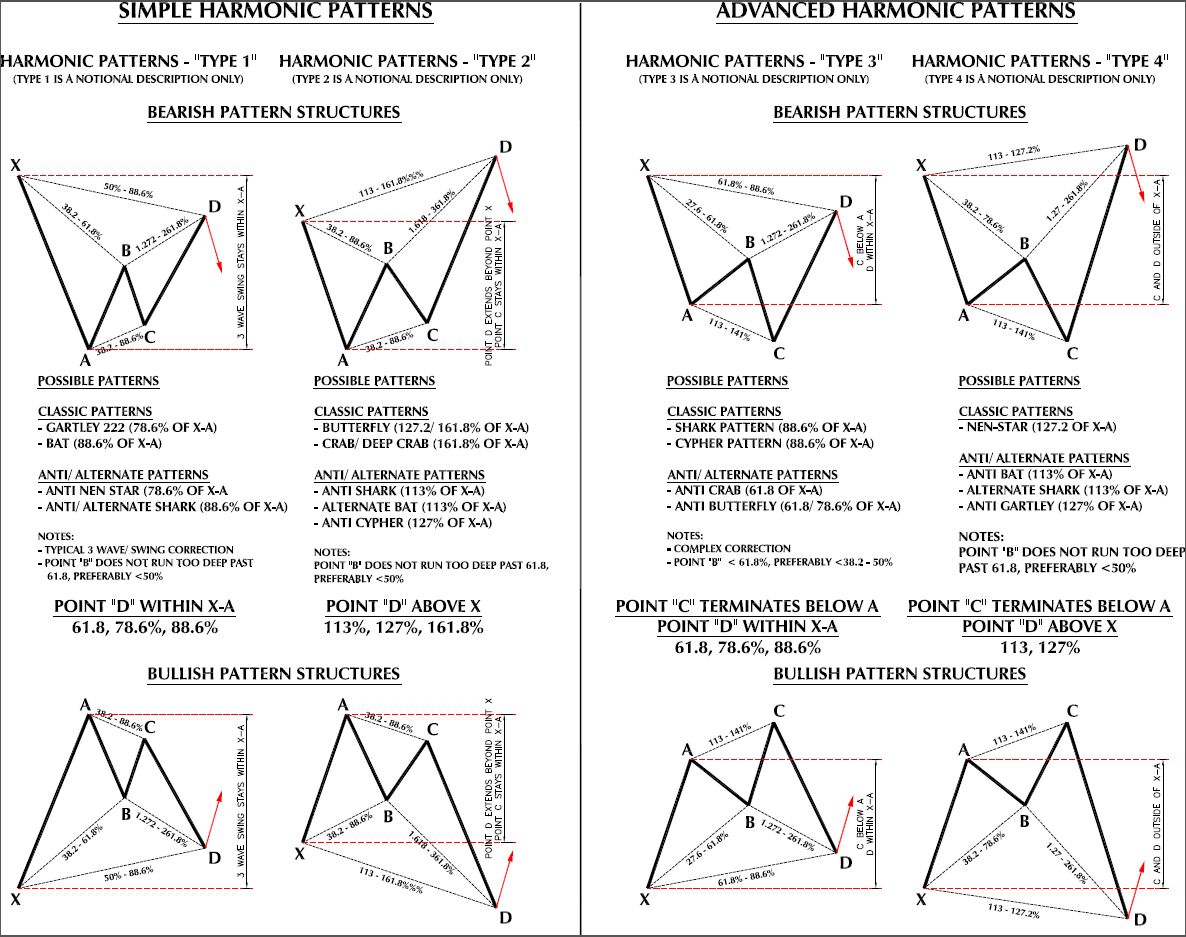

Scott Carney discovered and formalised most of the harmonic patterns of various financial markets. These patterns are a succession of up and down legs (price moves). Depending on the pattern, they are composed of 3 to 5 legs (created by 4 to 6 points). In addition, these legs follow strict mathematical ratios.

Harmonic Patterns

The common types are the AB=CD Pattern, Gartley Pattern, Bat Pattern, Butterfly Pattern, Crab Pattern, Shark Pattern, and Cypher Pattern, and each of them has a different geometrical shape and Fibonacci ratio. Why harmonic patterns work While the harmonic patterns do not work all the time, they do present a reliable and tradable edge in the market.

Harmonic Patterns AFL Code for Amibroker

Types of Harmonic Patterns There are many types of harmonic patterns that include; Gartley Pattern This is a simple harmonic pattern that was developed by Harold McKinley Gartley. The Gartley Pattern, also known as the 222 pattern is a harmonic pattern usually preceded by a significant low or high. The Gartley pattern is usually formed when

fx Akrivos Θεωρία Τεχνικής Ανάλυσης HARMONIC PATTERNS (ΒΑΣΙΚΟΙ)

The concept of Harmonic Patterns was established by H.M. Gartley in 1932. Gartley wrote about a 5-point pattern (known as Gartley) in his book Profits in the Stock Market. Larry Pesavento has improved this pattern with Fibonacci ratios and established rules on how to trade the "Gartley" pattern in his book Fibonacci Ratios with Pattern Recognition.

Harmonic Pattern Trading Strategy Explained With PDF Cheat Sheet

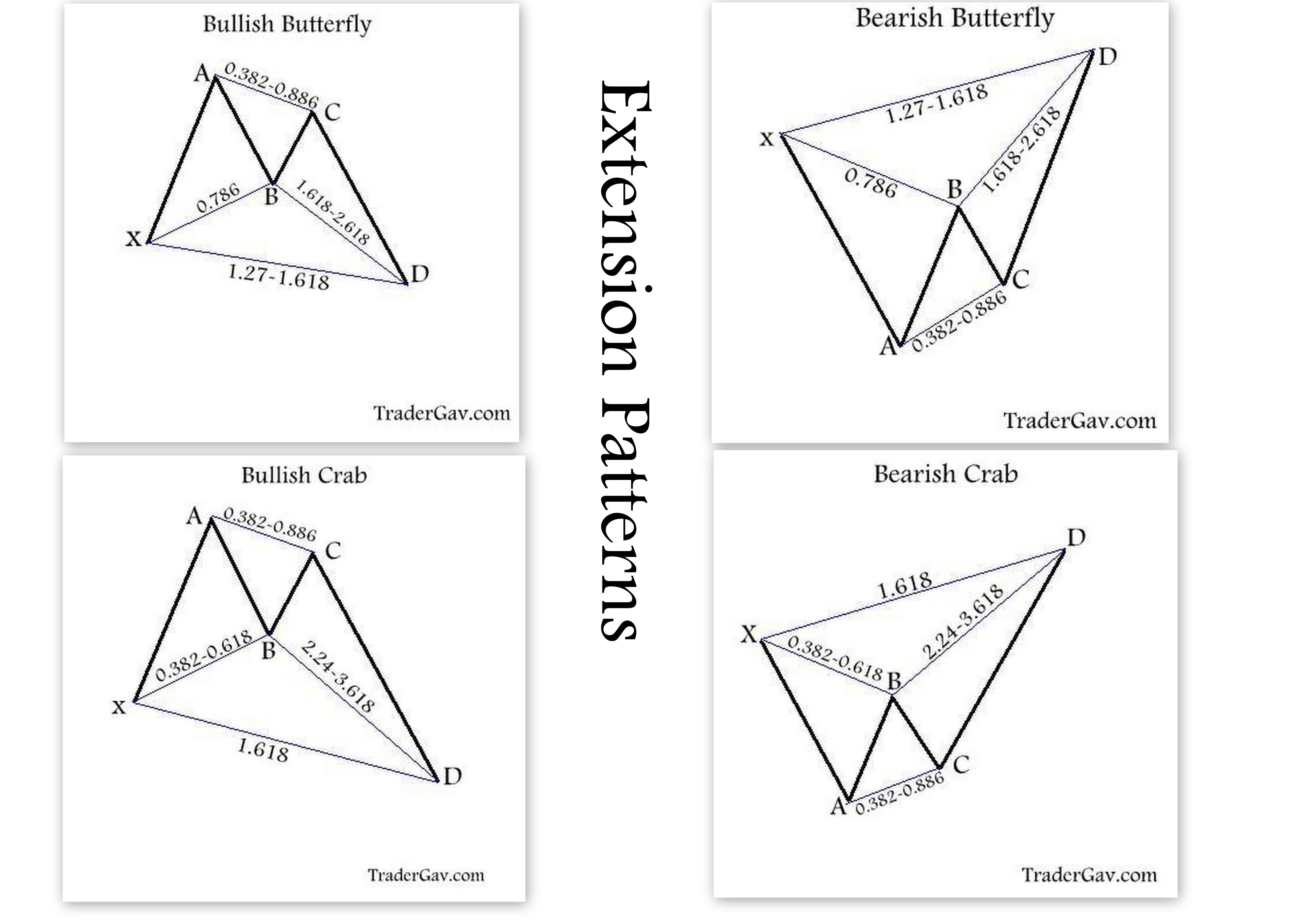

Learn how to identify and trade harmonic extension patterns with this handy cheat sheet. This PDF file provides a quick overview of the most common extension structures, such as the Crab, the Butterfly, and the Shark. Download it for free and enhance your harmonic trading skills.

Binary options Thailand Forex harmonic patterns cheat sheet

The unique characteristic of harmonic patterns is that they use natural patterns, Fibonacci ratios, and fix rules or requirements. That's why these patterns work in trading as well as are easy to trade. A newbie trader will find it difficult to spot harmonic patterns on the chart but with the screen time, you will master these patterns.

Harmonic Patterns Cheat Sheet New Trader U

Harmonic patterns are geometric price patterns derived from Fibonacci ratios used to predict future price movements. In this paper, the profitability of trading some common bullish harmonic patterns, including the Gartley, butterfly, bat, and crab, in the US stock, Forex, and Crypto market is evaluated.

Accurately Identify Harmonic Patterns

Harmonic patterns are a type of advanced trading pattern that take place naturally in financial charts. These patterns follow geometric price action and Fibonacci levels. Harmonic patterns can be defined as trend reversal patterns based on retracement levels, geometric structures and Fibonacci extensions.